Industry News: Apartment Market Hot Steak Continues

Despite Lack of Capital, Survey Finds 18 months of Uninterrupted Growth

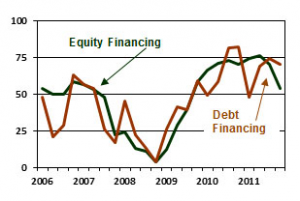

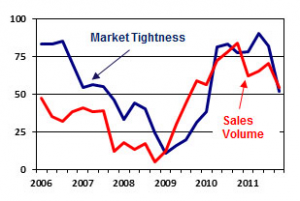

For the sixth quarter in a row, the apartment industry improved across all indexes in the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (76), Sales Volume (54), Equity Financing (58) and Debt Financing (77) all measured at 50 or higher, indicating growth from the previous quarter.

“The apartment sector’s strength continues unabated,” said NMHC Chief Economist Mark Obrinsky. “Even as new construction ramps up, higher demand for apartment residences still outstrips new supply with no letup in sight. Despite the need for new apartments, acquisition and construction finance remains constrained in all but the best properties in the top markets.”

“The apartment sector’s strength continues unabated,” said NMHC Chief Economist Mark Obrinsky. “Even as new construction ramps up, higher demand for apartment residences still outstrips new supply with no letup in sight. Despite the need for new apartments, acquisition and construction finance remains constrained in all but the best properties in the top markets.”

Key findings include:

Financing is available, but only for top markets. Only 16 percent reported acquisition capital being available in all markets at all times. Even fewer (10 percent) stated that construction capital was available across markets. The majority reported that acquisition financing (65 percent) and construction financing (52 percent) was only available in top-tier markets.

Majority report increased market tightness. The Market Tightness Index edged up to 76 from 74. For the first time in a year, more than half (55 percent) of respondents said that markets were tighter. By contrast, only 2 percent reported the markets as loosening and 43 percent reported no change over the past three months.

Majority report increased market tightness. The Market Tightness Index edged up to 76 from 74. For the first time in a year, more than half (55 percent) of respondents said that markets were tighter. By contrast, only 2 percent reported the markets as loosening and 43 percent reported no change over the past three months.

The Sales Volume Index dipped slightly to 54 from 57. Nearly one quarter (24 percent) of respondents reported increased sales volume, compared to 16 percent who indicated decreased volume and 55 percent who reported conditions as unchanged since the last quarter.

The Sales Volume Index dipped slightly to 54 from 57. Nearly one quarter (24 percent) of respondents reported increased sales volume, compared to 16 percent who indicated decreased volume and 55 percent who reported conditions as unchanged since the last quarter.

Equity financing continues three years of growth. The Equity Financing Index shrank slightly to 58 from 62; this marked 12 straight quarters of the index at or above 50, indicating positive activity in the equity market.

Debt financing highest in two years. The Debt Financing Index jumped to 77 from 65, with only 2 percent reporting borrowing conditions as being worse from the previous quarter. This reflects the sixth quarter in a row that the share of respondents who thought the availability and terms of debt financing had worsened was in the single digits.

Full survey data are available at www.nmhc.org/goto/60885 – About the survey: The July 2012 Quarterly Survey of Apartment Market Conditions was conducted July 16-24, with 82 CEOs and other senior executives of apartment-related firms nationwide responding.

About NMHC

Based in Washington, DC, NMHC is a national association representing the interests of the larger and most prominent apartment firms in the U.S. NMHC’s members are the principal officers of firms engaged in all aspects of the apartment industry, including owners, developers, managers and financiers. One-third of Americans rent their housing, and over 14 percent live in a rental apartment.

For more information, contact NMHC at 202/974-2300, e-mail the Council at info@nmhc.org, or visit NMHC’s website at www.nmhc.org