Multifamily Finance Trend | Real Estate Crowdfunding: Is Technology Cutting out the Middle Man?

As real estate crowdfunding builds a head of steam behind the JOBS Act, what are the benefits and initial concerns that will make or break this budding industry?

As real estate crowdfunding builds a head of steam behind the JOBS Act, what are the benefits and initial concerns that will make or break this budding industry?

“It is really this access problem.” says RealtyShares co-founder Nav Athwal and his partner Trey Clark. “The fact of the matter is, there is no easy-to-access marketplace for even investors to access a reliable source of quality private real estate investments and thus investors have traditionally invested in what is readily available – stocks, bonds and mutual funds.”

When President Obama signed the JOBS Act in April of 2012, the crowdfunding industry achieved what has been identified in the industry as having “potential to be a game changer” for future private equity fundraising efforts. According to RealtyShares, the JOBS Act brought about for the first time since the great depression and the enactment of the Securities Act of 1933, the opportunity for unaccredited investors to be able to participate in a private equity deal.

This is a huge step for investors looking to take advantage of the fact that private equity investments in the U.S. have traditionally outperformed the stock market. Up until the signing of the JOBS Act, these private equity deals were reserved for only for the wealthiest investors, while the average investor was left to invest in the public markets.

And while the JOBS Act is considered by most to be a step towards balancing this inequality, it does have its limits. For both investors and fundraisers, understanding these limits is crucial. For starters, some of these limits may be prohibitive when it comes to private real estate deals and the act sets a $1 million per issuer, per year fundraising ceiling in addition to possible exorbitant compliance requirements.

One of the biggest benefits of crowdfunding real estate is that it allows investors greater access to deals and it offers a way for them to diversify portfolio.

“If you take a standard investment portfolio, allocated 60% to stocks and 40% to bonds, and reallocate a 20% portion of it to private real estate, you not only increase returns but reduce volatility.” adds Mr. Athwal.

Platforms, like the one RealtyShares operates, allow investors to invest passively in private real estate investments, all while managing the transactions as they would when investing in either stocks or bonds.

With technology, the industry is able to increase the transparency around how capital is raised for private real estate investments and the fees that real estate firms then charge investors.

According to Nav at RealtyShares, “Real estate has been operating under the country club model for too long. The fees operators have traditionally charged investors to pool their funds, acquire properties, and manage the final real estate assets are typically hidden amongst a ton of legal jargon.”

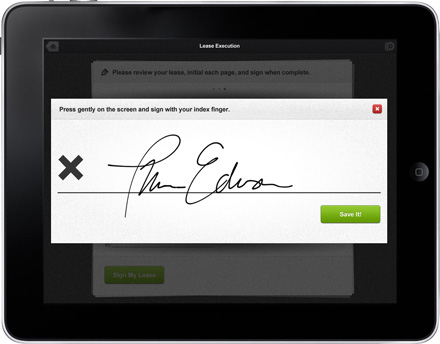

Technology makes the entire process of crowdfunding possible. Without it, this market wouldn’t be possible. Technology allows crowdfunding to adapt and overcome these shortfalls to allow prospective investors to have this desired transparency and increased accountability.

From a logistical standpoint, technology allows for not only the feasible managing of multiple transactions, but also makes it possible to reduce costs through the added efficiency. This efficiency opens up the door for smaller investors who want to get involved in deals with a minimal investment of $5,000 in most cases.

Does this spell the end of the real estate middle man?

“I think that technology enables more information to the investor and better decision making, however the middle man will still always be a part of the process,” says crowdfunding investor Justin Miller, “We will always need someone chasing and sourcing great deals.”

|

Justin Alanis | Company Website | LinkedIn Connect |

Justin Alanis is the Co-Founder and CEO of Rentlytics Inc. Rentlytics is based in San Francisco, CA providing deep analytics for apartment property owners and managers. View and analyze property operational and financial metrics more effectively and identify issues. |

One of the biggest problems facing today’s entrepreneurs is the lack of access to financing. In fact,

One of the biggest problems facing today’s entrepreneurs is the lack of access to financing. In fact,

A gradual shift in the American Dream from home ownership to renting has some U.S. developers of multifamily housing and real estate market analysts (like the CoStar Group) worried over a threat of overbuilding. The concern is that the rapid increase in rental demand will eventually (and soon) dwindle, leaving a plenitude of “sitting empty” apartments and apartment buildings.

A gradual shift in the American Dream from home ownership to renting has some U.S. developers of multifamily housing and real estate market analysts (like the CoStar Group) worried over a threat of overbuilding. The concern is that the rapid increase in rental demand will eventually (and soon) dwindle, leaving a plenitude of “sitting empty” apartments and apartment buildings.